TSLA Stock: A Comprehensive Guide for Investors

TSLA stock, the symbol representing Tesla, has been a focal point for both seasoned investors and newcomers alike. Its journey has been nothing short of remarkable, with Tesla evolving from a niche electric vehicle (EV) manufacturer into a tech and energy powerhouse. But investing in TSLA stock is about more than just the company’s current market position—it’s about participating in a forward-thinking revolution.

The Evolution of TSLA Stock

Tesla began its journey as a luxury electric vehicle maker, catering to a small but passionate market. Over time, the company has expanded its vision, leading to the rise of stock. Today, Tesla stands as more than an automaker. It’s a tech company, an energy innovator, and a pioneer in autonomous driving technology. This expansion beyond cars is one of the main reasons why TSLA stock has captured the attention of investors worldwide.

The rapid appreciation of TSLA stock has ignited debates about its true value. Some analysts argue Tesla’s current stock price reflects its future potential, while others caution that the company is overvalued. Regardless of where one stands, the fact remains that stock represents a leader in the global shift toward electric transportation.

Why Investors Flock to TSLA Stock

Several factors make stock attractive. First, Tesla’s strong brand and relentless pursuit of innovation have made it a darling among both retail and institutional investors. Tesla consistently challenges traditional boundaries, not only in the automotive industry but also in energy production and storage. This innovative drive is a significant reason behind the high demand for TSLA stock.

Moreover, Tesla’s ventures into solar energy, home battery storage, and autonomous driving systems provide additional layers of growth potential. Investors view stock as an opportunity to gain exposure to these developing markets. This broad scope is what makes TSLA stock more than just an investment in electric cars—it’s an investment in a sustainable future.

The Volatile Nature of TSLA Stock

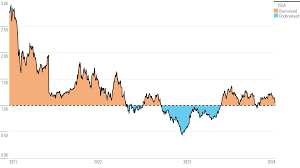

Since Tesla’s initial public offering (IPO), TSLA stock has seen its fair share of volatility. The stock’s price is known for fluctuating significantly, often in response to company announcements, quarterly earnings reports, or statements from Elon Musk, Tesla’s CEO. When Tesla achieves a production milestone, the stock often rises sharply. Conversely, delays or negative news can send the stock down just as quickly.

For investors, this volatility can be both a blessing and a curse. While short-term traders may capitalize on these fluctuations, long-term holders of stock are typically more focused on the company’s long-term growth prospects. Understanding and preparing for these price swings is essential for anyone considering a stock investment.

The Impact of Elon Musk

One of the most significant influences on TSLA stock is Elon Musk himself. As Tesla’s CEO, Musk is known for his bold vision and unorthodox leadership style. His desire to revolutionize industries ranging from transportation to space exploration has earned him a massive following. Many investors are drawn to stock because they believe in Musk’s ability to execute on his ambitious plans.

That said, Musk’s outspoken nature and controversial public statements have also led to occasional turmoil in the markets. His tweets, in particular, have sometimes caused wild price swings in stock. Despite these moments, most investors remain confident in Musk’s leadership, seeing him as the driving force behind Tesla’s ongoing success.

What’s Next for TSLA Stock?

Looking ahead, the future of TSLA stock is intertwined with Tesla’s long-term goals and the broader trends in the EV market. Tesla is committed to expanding its vehicle lineup, developing fully autonomous cars, and leading in renewable energy solutions. If Tesla can execute these ambitions, the potential for the stock to grow further is significant.

Additionally, the global demand for electric vehicles is on the rise. Governments worldwide are pushing for stricter emissions standards and offering subsidies for EV purchases. This growing market, combined with Tesla’s technological advantages, provides a favourable backdrop for the stock’s future performance.

Critical Metrics to Watch in TSLA Stock

When analyzing TSLA stock, investors should keep an eye on several key metrics. Tesla’s production capabilities are vital to its success. Meeting consumer demand while maintaining high production efficiency is essential for sustaining investor confidence and stabilizing stock.

Autonomous driving technology is another critical area. If Tesla can perfect and roll out fully self-driving vehicles, it could revolutionize the automotive industry and significantly boost TSLA stock’s value. Additionally, Tesla’s expansion into new markets, especially in Europe and Asia, will be important to watch, as it could lead to long-term growth for the stock.

Finally, Tesla’s energy division, which focuses on solar power and battery storage, represents another growth opportunity for stock. This diversification into renewable energy could further solidify Tesla’s position as a leader in sustainable technologies.

Potential Risks

Despite its potential, TSLA stock is not without its risks. The EV market is becoming increasingly competitive, with legacy automakers like Ford and General Motors entering the space, as well as numerous startups. If Tesla fails to maintain its technological edge, this could impact its market share and the performance of stock.

Moreover, regulatory challenges could pose risks. Tesla operates in multiple countries, each with its own regulatory environment. Changes in environmental policies, safety standards, or trade agreements could disrupt Tesla’s operations and, by extension, affect =stock.

Is TSLA Stock Right for Your Portfolio?

Deciding whether to invest in TSLA stock depends on your risk tolerance and investment goals. Tesla’s growth prospects are undeniable, with the company innovating in multiple high-potential industries. However, the volatility of stock means that it’s not for the faint of heart.

For risk-tolerant investors, stock offers an opportunity to be part of a company that is shaping the future of transportation, energy, and beyond. However, for those who prefer more stability, the wild price swings associated with stock may be off-putting. As always, it’s essential to conduct thorough research and consider your own financial situation before making any investment decisions.

Final Thoughts

TSLA stock remains one of the most popular and closely watched investments on the market. Tesla’s ability to innovate, disrupt industries, and set ambitious goals has made it a favourite among many investors. Whether you’re excited about electric vehicles, renewable energy, or autonomous driving technology, stock provides exposure to all of these fast-growing sectors.

However, with great potential comes great risk. stock’s volatility, the challenges Tesla faces in maintaining its market leadership, and the ever-evolving competitive landscape are all factors to consider. For those willing to take the risk, TSLA stock offers a chance to invest in a company that is revolutionizing the way we think about energy and transportation.

In the end, stock represents more than just an investment in an automaker. It is a symbol of the future, where sustainability, innovation, and technology merge to create a better world. As Tesla continues to push the boundaries, stock will remain at the forefront of investors’ minds, offering both risk and reward.